What we offer

We are legacy experts, offering legal, economic and operational finality.

Through our extensive experience and diverse skills sets, we offer bespoke solutions that enable our clients to reach their own business objectives and to focus on what is core for them. We deliver transaction and execution excellence through our one-team approach.

![]()

We have significant experience in multiple classes of direct and reinsurance business, particularly in US asbestos and environmental; other classes include property, liability, marine, medical malpractice, habitation and motor.

We protect clients’ reputation through diligent and proactive claims management; your clients are our clients.

Reasons to exit legacy

Exiting your legacy business will help your company achieve capital and operational optimisation it will enable you to:

Release capital

read moreRelease capital

Strengthen solvency and release capital to deploy to core business and exploring new business opportunities

Achieve finality

read moreAchieve finality

Achieve finality and remove the drag caused by non-core legacy business, including management distraction

Operational optimisation

read moreOperational optimisation

Address operational changes such as IT developments or loss of experience, knowledge or people

Reduce volatility

read moreReduce volatility

Address the volatility involved in long tail claims which can be difficult to predict

Routes to exit

Portfolio Transfer

Offers full legal and economic finality of all insurance liabilities

Local jurisdiction determines mechanism of transfer

Operational finality is achieved once the transfer is complete

Usually takes three-six months; a reinsurance agreement is typically put in place to deliver immediate economic finality

Company Acquisition

The sale of 100% of the shares in the company in run-off

Structured as a Share Purchase Agreement

Non-insurance due diligence is required

Requires the approval of local regulators

Legal, economic and operational finality on completion of deal usually takes 3 to 6 months in Continental Europe

Reinsurance Solution

Loss Portfolio Transfer (LPT)

Provides economic and operational finality (if desired) for the client but no legal finality

Typically achieved by agreeing the terms of a 100% Net Quota Share reinsurance agreement

Effective upon signing

A Reinsurance To Close (RITC) is a reinsurance but provides full finality

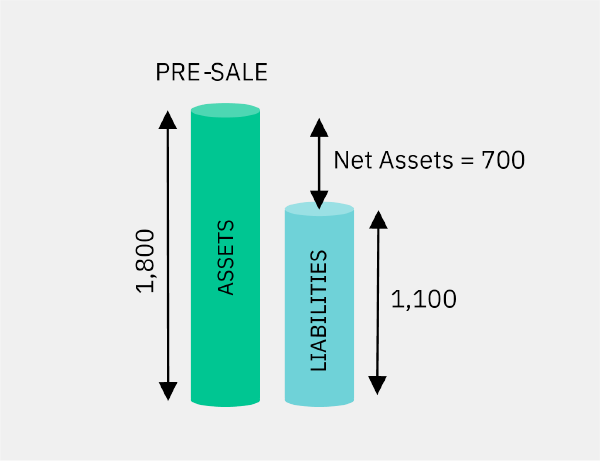

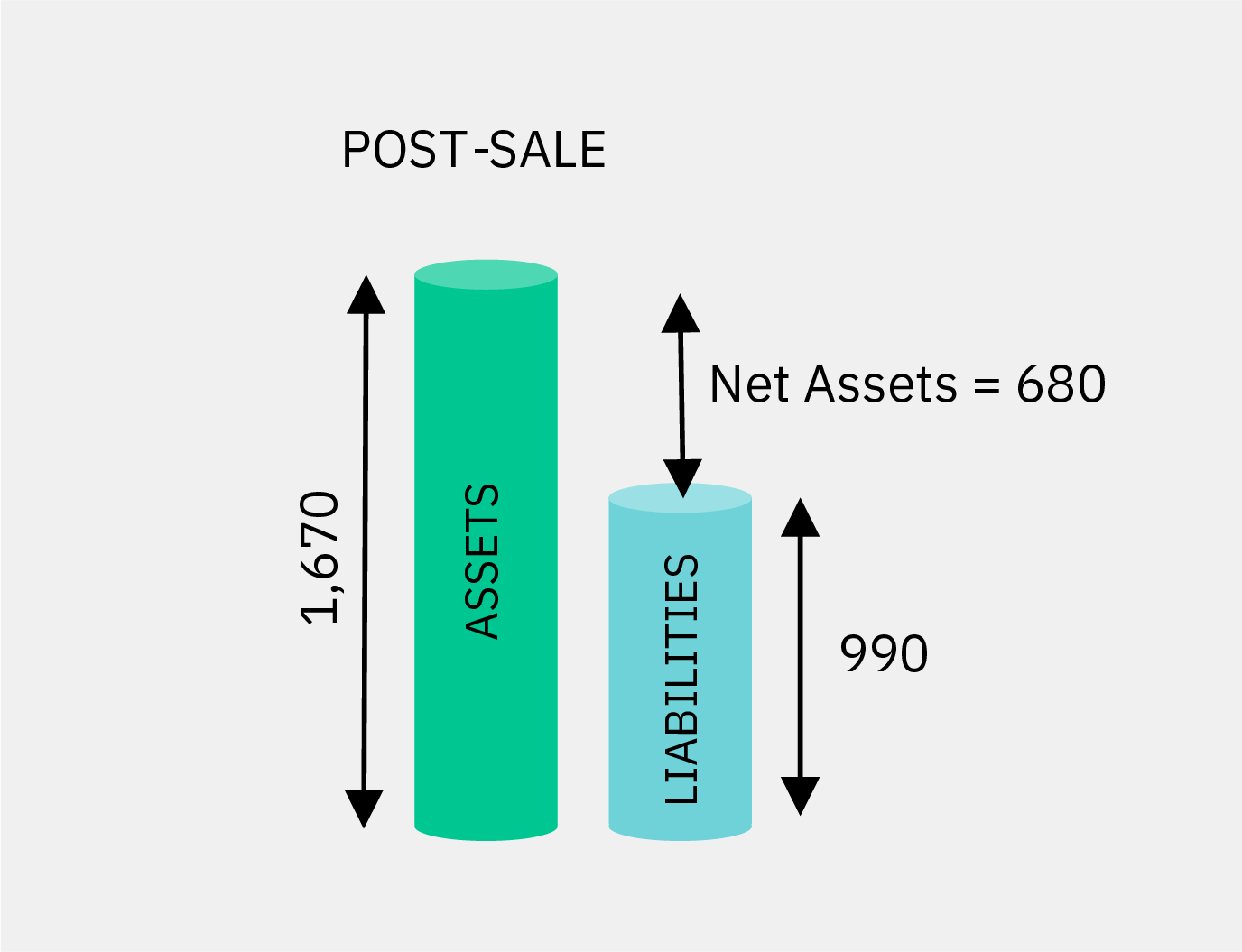

Capital & solvency benefits

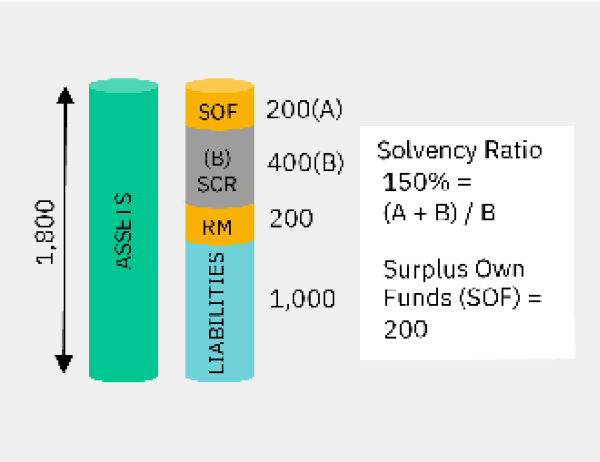

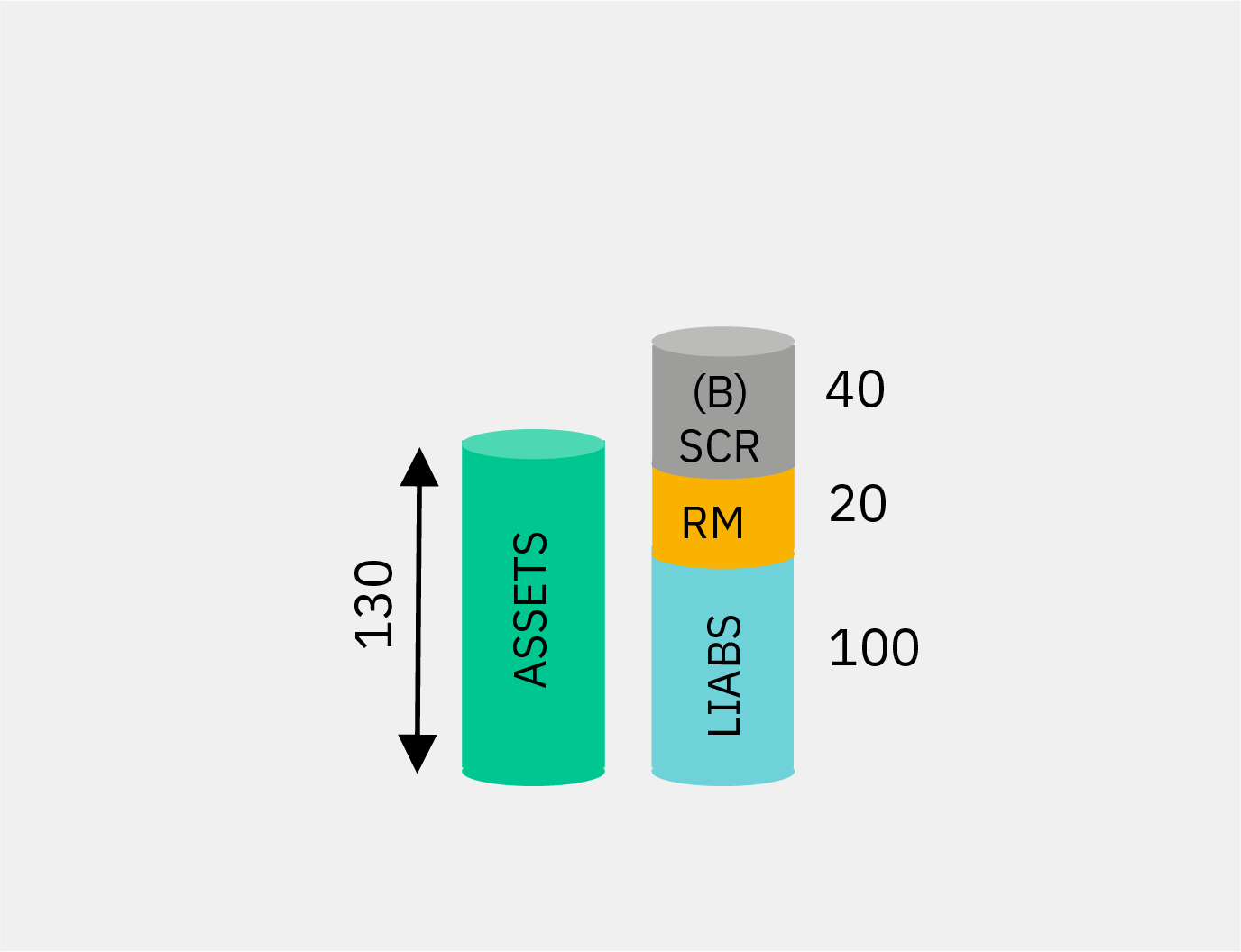

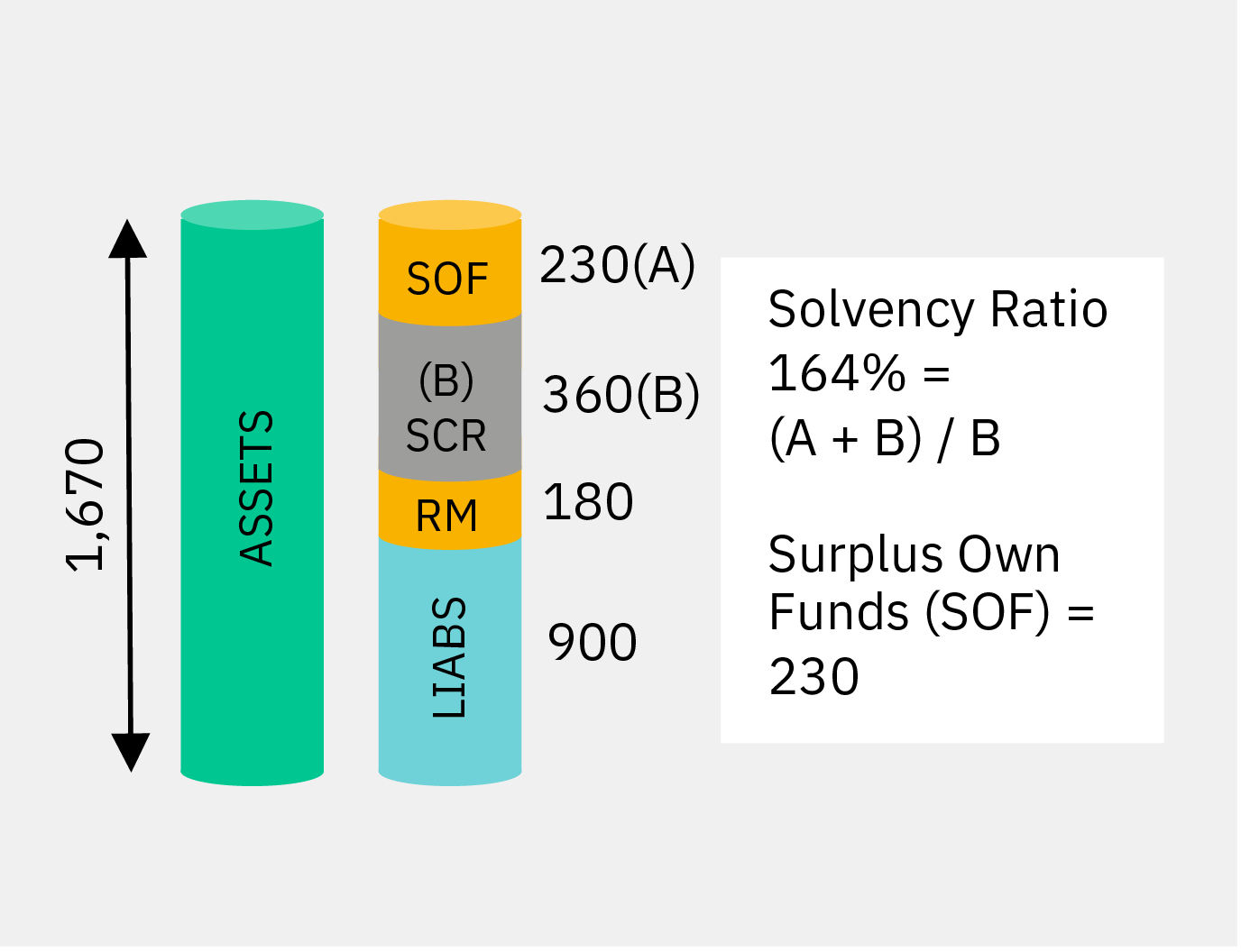

Worked example

| Assets | |

| (Local/regulatory Capital basis) | 1,800 |

| Technical Provisions (incl. ULAE) | |

| Local basis | 1,100 |

| Regulatory Capital basis (discounted) | 1,000 |

| Risk Margin (20% of TPs) | 200 |

| SCR (40% of TPs) | 400 |

| Liabilities | |

| (Local/regulatory Capital basis) | 1,800 |

| Technical Provisions (incl. ULAE) | |

| Local basis | 1,100 |

| Regulatory Capital basis (discounted) | 1,000 |

| Risk Margin (20% of TPs) | 200 |

| SCR (40% of TPs) | 400 |

Local basis

Regulatory capital

Our ethos & approach

We have a unique ethos and approach to the way in which we engage in our market, our clients and delivery of our solutions. Our goal is to exceed clients’ expectations and to deliver that through a collaborative and transparent transaction experience. Every time.

Mid-market focus

read moreMid-market focus

Our emphasis on mid-market transactions ensures we provide focus and expertise to deliver a personalised service to the clients who entrust us with their policyholders.

Strong relationships

read moreStrong relationships

We focus on building long-term partnerships with our clients, building trust both during and after our transactions and consistently exceeding our clients’ expectations.

One-team approach

read moreOne-team approach

Our Integrated ‘one-team’ mindset supports the development and delivery of holistic client focused solutions.

Disciplined underwriting

read moreDisciplined underwriting

Our thorough and collaborative underwriting approach ensures that we deploy the right level of subject-matter expertise to every transaction.

Scalable operating model

read moreScalable operating model

We employ a highly scalable operating model suited to each unique market in which we operate.