We provide flexible, regulatory-approved transaction structures tailored to your business case and strategic objectives.

We provide capital and liability solutions

We protect clients’ reputation through diligent and proactive claims management; your clients are our clients.

Collaboration through long terms partnership

At Compre, we offer certainty, partnership, and performance. We forge lasting relationships built on trust, collaboration, and disciplined deal-making.

With global reach and local expertise across Europe, North America, and Lloyd’s, we deliver tailored legacy solutions that align with our risk appetite and create sustainable value. Our focus on underwriting and claims excellence helps our clients release capital, manage risk effectively, and focus on the future.

Through our extensive experience and diverse skills sets, we offer bespoke capital and liability solutions that enable our clients to reach their own business objectives and to focus on what is core for them. We deliver transaction and execution excellence through our one-team approach.

We have significant experience in multiple classes of direct and reinsurance business, particularly in US asbestos and environmental; other classes include property, liability, marine, medical malpractice, habitation and motor.

Benefits of partnering

Compre’s strategy is driven by building long term client relationships and structuring solutions to meet the transaction rationale and business case for our clients in multiple geographies.

Our solution overview

Each solution is designed with flexibility, alignment, and long-term partnership in mind. We go beyond pure risk transfer to offer consultancy and post-deal management, ensuring our clients achieve their strategic and financial objective

We have significant experience in multiple classes of direct and reinsurance business, particularly in US asbestos and environmental; other classes include property, liability, marine, medical malpractice, habitation and motor.

Retrospective Reinsurance

Loss Portfolio Transfer ‘LPT’

Provides economic finality and risk reduction

Flexibility on claims control

Regulatory approval by Compre’s home regulator

Portfolio Transfer

Provides both economic and legal finality

Compre assumes full claims control

Regulatory approval managed in home jurisdictions

Company Acquisition

Complete exit via entity sale

Full economic and legal finality

Efficient capital release and operational simplification

Flexible transaction structuring

Attuned to client motivation and alignment

Focus on post-deal stakeholder management

Partnership by providing value-added services and consultancy.

Decisive, diligent and delivering on client objectives

Client objectives

Facilitate a strategic repositioning to focus on a balance of direct & reinsurance business

Exit from Property Cat reinsurance & certain local markets

Releasing capital and operational resource to support go-forward underwriting strategy

Retention of Assets

Backing Reserves to support liquidity management

Hybrid claims management to support new claims leadership

Execution speed and certainty to support market messaging

Client solutions

Loss Portfolio

Transfer mechanism to provide maximum economic finality

Quick regulatory approval process and contract execution

Collaborative diligence process

Premium retained by the client to provide flexibility around liquidity

Collaborative post-deal operational approach

Client to retain control of key accounts and Compre to support efficient claims management

Overview of $1.3bn Portfolio

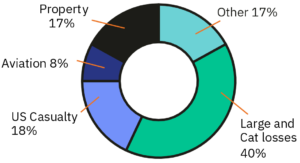

Liabilities by segment

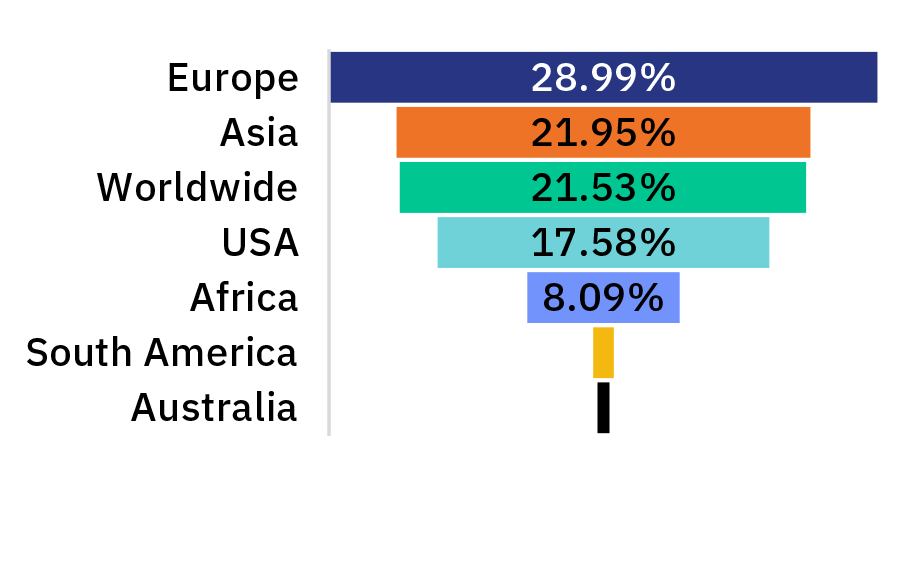

Liabilities by region

“We are delighted to assist SiriusPoint with the strategic repositioning of its reinsurance business. This transaction continues a valuable relationship, providing both significant diversification and growth to our balance sheet and enabling SiriusPoint to meet its strategic goals.”

Will Bridger, Compre CEO

“This is a transformational deal for SiriusPoint. The expected substantial capital release should further increase our balance sheet strength. I am pleased we are partnering with Compre once again, continuing a valued relationship with a transaction that supports us in realising SiriusPoint’s full potential.”

Scott Egan, SiriusPoint CEO